Accounting for influence

by CORPORATE EUROPE OBSERVATORY 11 July 2018

|

| TAX JUSTICE & CURBS ON CAPITAL-FLIGHT |

My editorial introduction: TAX-HAVENS - ADVICE OR FRAUDULENT CONSPIRACY?

Once upon a time, when there were the Big-5, the giant auditors and tax-planners Arthur Andersen led the global field. That huge firm of 85,000 accountants was struck-off by the USA for their corporate structuring and auditing role in the notorious ENRON affair, one of the costliest scams in corporate history. "Then there were 4..." as the nursery rhyme goes.

The international corporate world is now audited, reported and tax-planned by just four organisations, THE BIG 4, each with about 250,000 employees worldwide - KPMG, PriceWaterhouseCoopers (PwC), Ernst & Young (EY), and Deloitte. Due to their global dominance in the business world, it is hardly surprising that each of them is increasingly scandal prone; accused of blinkered auditing, suppressed reporting of awkward facts and dodgy tax-planning. The tax-planning skirts the claimed alleged legality of Tax-Avoidance and Tax-Minimisation, drawing ever closer to dangerous and perilous Tax-Evasion. Some say Avoidance - some say Evasion. The latter is criminal behavior, with huge fines and long prison sentences.

Government paid Big Four more than half a billion pounds Deloitte ...

https://economia.icaew.com/.../government-paid-big-four-more-than-half-a-billion-po...

24 Oct 2016 - The UK government has paid PwC, Deloitte, EY and KPMG more than half a billion pounds in fees over the past three years.Big Four accused of "feasting" on Carillion as ... - Consultancy.uk

https://www.consultancy.uk/.../big-four-accused-of-feasting-on-carillion-as-combined...

12 Mar 2018 - Executives from the Big Four of PwC, EY, KPMG and Deloitte have come under ... PwCwas paid most of the four in fees, bringing in a total of £21.1 million, ... PwC brought in a further £6.5 million from government contracts i

Advice on evading taxes is not confined to ENRON type corporations. THE BIG 4 have units to advise individuals - Private Persons - on "Wealth Management" which naturally includes tax-planning - because "Only Little People Pay Tax". This (long) article below, on NEVIS, coincides with that archetypal Englishman, 78 years old comedian John Cleese, announcing he will move to Nevis in November; "They are such nice people". I guess he has moved his Intellectual Property to Nevis a long time ago - and thus his (not taxable) income from a lifetime of fame stemming from Monty Python. The lost tax is a blow to national treasuries, but the far greater national damage is from the accompanying Capital-Flight. Usually, efficient tax-planning requires that all the capital is shifted to tax-havens - depleting the assets of nations and communities. The estimate of such tax-unpaid assets is more than $32 Trillion (80 million good jobs). In turn, Capital-Flight causes "austerity" in the source regions. The UK's Capital-Flight is estimated at £2.3 Trillion - a vast sum; which is why I think that UK ViP Quitters are in fact tax-evaders escaping EU restrictions from European Courts - the freedom to not pay tax.

On one hand THE BIG 4 advise clients how to reduce taxes and frustrate government rules, while on the other hand they are deeply embedded as consultants to, and in committees for, those same governments about how to devise tax-policies and collect taxes. An Alice-in-Wonderland world of revolving doors and conflicts of interest. The Tax-Justice-Network says the Big-4 should not do both.

DUMMY OFFSHORE COMPANIES - ONLY $79.99

On one hand THE BIG 4 advise clients how to reduce taxes and frustrate government rules, while on the other hand they are deeply embedded as consultants to, and in committees for, those same governments about how to devise tax-policies and collect taxes. An Alice-in-Wonderland world of revolving doors and conflicts of interest. The Tax-Justice-Network says the Big-4 should not do both.

Nevis: how the world's most secretive offshore haven ... - The Guardian

https://www.theguardian.com/.../nevis-how-the-worlds-most-secretive-offshore-haven...

8 hours ago - The long read: The years since 2008 have seen a global crackdown on ... In shortHow the Big Four are embedded in EU policy-making on tax avoidance

We pay our taxes, so why don’t corporations? This new report shows how the Big Four are embedded in EU policy-making on tax avoidance, and concludes that it is time to kick this industry out of EU anti-tax avoidance policy.

Download the full report. The summary briefing is available in English, Deutsch, Español, and Français.

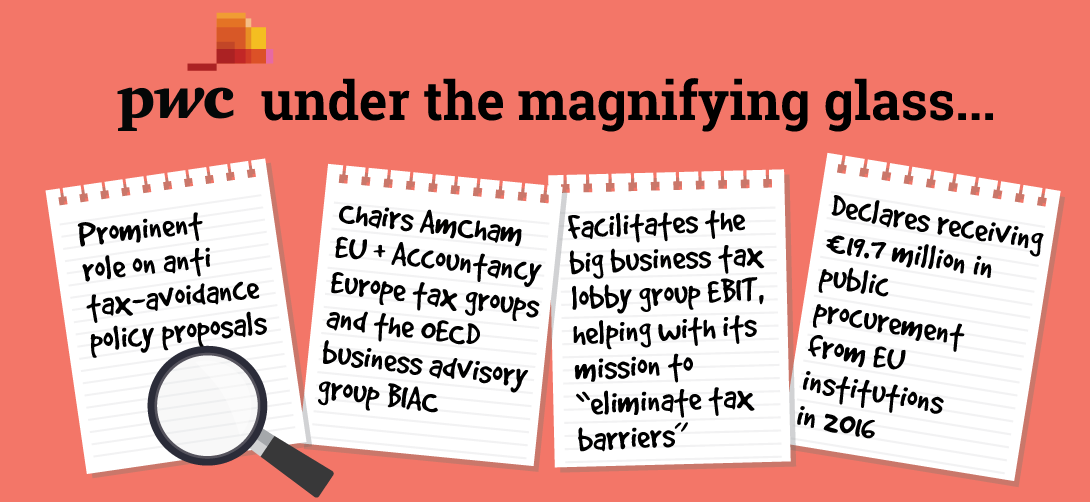

EU policy towards corporate tax avoidance is informed by an advisory system littered with conflicts of interest. Despite all the evidence – from the various tax leaks, scandals, and parliamentary enquiries and reports – of the role the 'Big Four' global accountancy firms play in facilitating, encouraging, and profiting from corporate tax avoidance strategies, they continue to be treated in policy-making circles as neutral and legitimate partners.

Advisory groups giving the Commission 'expert' opinions on its tax policy are populated by both corporate interests and members of the tax avoidance industry. At the same time the EU is paying millions for private ‘expertise’ in the form of tax-related policy research from the Big Four. The tax avoidance industry, particularly the Big Four, also have ‘informal’ channels of influence, using lobby vehicles like the European Business Initiative for Taxation, the European Contact Group, Accountancy Europe, and AmCham EU. And a normalised revolving door between the Big Four and EU institutions perpetuates a shared culture and ideology.

The lobbying and influence of tax intermediaries like the Big Four (and the multinational corporations they sell tax avoidance schemes to) is illustrated by two EU case studies: on new transparency rules for tax planning intermediaries, and on public country-by-country tax reporting, a proposal which is yet to be agreed by the EU institutions.

This report concludes that it is time to kick the Big Four and other players in the tax avoidance industry out of EU anti-tax avoidance policy. The starting point for this must be recognition of the conflict of interest in allowing tax intermediaries to advise on tackling tax avoidance. Only then can an effective framework emerge to ensure public-interest tax policy-making is protected from vested interests.

No comments:

Post a Comment